|

By Tim Cooper

LONDON (MNI) –

Source: MNI/Bloomberg

EGB SUMMARY: Italian bonds have had a rollercoaster ride this morning in an

otherwise subdued trading session, with the UK and US observing holidays.

– 10Y BTPs widened to as much as 233.6bps over Bunds after dropping to 189.90

early in the session, last trading 219.3bps, 13.8bps wider. Spreads are entering

levels not seen outside crisis (i.e. 2011-13).

– Former IMF staffer Cottarelli has now been awarded the mandate with which to

construct a technocratic government after turning down the MS5/League

coalition’s proposed economy minister Savona, opening the way for a next-year

budget to be passed before fresh elections in 2019. However, Cottarelli said if

he doesn`t win a confidence vote, there would be elections ‘after August’.

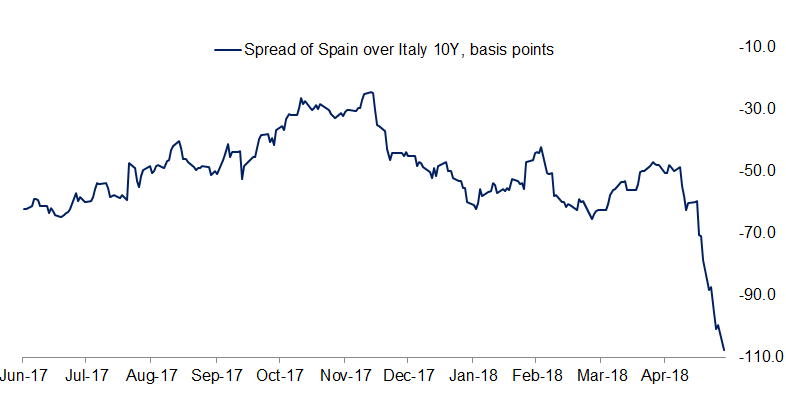

– In Spain meanwhile, PM Rajoy faces a no-confidence vote Friday. Spain 10Y

outperforming Italy by 6.9bps, but wider by 7.1bps vs Bunds.

– Bunds off their highs, but Jun18 future still up 25 ticks at 161.26.

– Longer-dated Euribor futures bear watching. The generic ER15 (Now Dec21) has

risen from 99.08 midmonth to 99.36, and is testing the downtrend since Sep 16.

– Thin on data, ECB`s Nowotny speaking at 1600GMT.

– US / UK cash markets closed for holidays.

AUCTION/SUPPLY:

ITALY BTPEI AUCTION RESULTS: Sold E1.25bln BTPei vs target E0.75-E1.25bln:

– Sold E.6465bln 0.10% May-22 BTPei; avg yld -.05% (-0.41%), cover 2.74 (2.07)

– Sold E.6035bln 1.30% May-28 BTPei; avg yld 1.28% (0.47%), cover 2.23 (1.44)

ITALY CTZ AUCTION RESULTS: Sold E1.75bln CTZ vs target E1.25-1.75bln:

– E1.75bln CTZ; avg yld 0.350% (-0.275%), cover 1.86 (1.58)

GERMAN T-BILL AUCTION RESULTS: Germany sold E2.0bln Aug 15, 2018 Bubill at

average yield -0.6047%, real cover 1.27 times, Buba cover 2.7 times, retained

52.5%.

DEBT FUTURE/OPTIONS:

EGB Option flow included:

* +5.0k Schatz Sep 112.10/112.30 call spread at 7

* -10k Schatz Sep 111.50 call at 1.5

* +9.5k Bobl Jul 131.25 put at 20

EGB Future flow included:

* 3,450 OATM8 @ 154.80

Source notes looks like OATs sold, alongside:

* 3,275 RXM8 @ 160.66

* 9,430 DUM8 @112.06

Euribor Swap future flow included:

* 8.7k RWM8 @ 112.345

LOOK AHEAD:

EUROZONE: *Timeline of key events in the Eurozone:

– May 28 ECB Nowotny to speak in Vienna at 1600GMT

– May 29 French May consumer sentiment at 0645GMT

– May 29 Italy May ISTAT consumer/business confidence at 0800GMT

– May 29 Eurozone M3 money supply for April at 0800GMT

– May 29 ECB Mersch speech in Frankfurt at 0930GMT

– May 29 ECB Lautenschlaeger speaks in Frankfurt at 1530GMT

– May 29 ECB Nowotny speaks in Vienna at 1700GMT

– May 30 German import/export prices at 0600GMT

– May 30 German Ilo unemployment change at 0600GMT

– May 30 German retail sales at 0600GMT

– May 30 France consumer spending at 0645GMT

– May 30 France 2nd estimate of Q1 GDP at 0645GMT

– May 30 German May unemployment rate at 0755GMT

– May 30 Eurozone Economic sentiment index at 0900GMT

UK: Timeline of key events in the UK

– May 28 UK late May-Day Holiday

– May 30 BRC shop price index at 0001BST

– May 31 GfK Consumer confidence for May at 0001BST

– May 31 BoE M4 money supply and mortgage approval data at 0930BST

US Data/speaker calendar (prior, estimate):

– May 29 StL Fed Pres Bullard, U.S. economy and mon/pol, Japan Center for Int

Finance’s Global Finance Seminar, Minato-ku, Tokyo, audience & media Q&A 0040ET

– May 29 Mar Case-Shiller Home Price Index (0.8, –) 0900ET

– May 29 May Conference Board confidence (128.7, –) 1000ET

– May 29 May Dallas Fed manufacturing index (21.8, –) 1030ET

–MNI London Bureau; +44 203 865 3807; email: tim.cooper@marketnews.com

|

![]()